Introduction

In the dynamic world of corporate responsibility, sustainability reporting has become a cornerstone for organizations striving to impact the environment positively. At the heart of this reporting is materiality, and in recent years, a renewal approach has emerged – the double materiality assessment. Mandated by the Corporate Sustainability Reporting Directive (CSRD), the European Sustainability Reporting Standards (ESRS) require thousands of European Union companies to conduct and disclose these assessments from 2024.

This blog post aims to give you a thorough understanding of double materiality. It guides you through the steps required in conducting a double materiality assessment to comply with the CSRD.

What is double materiality?

Before we dive into the assessment of double materiality and the steps involved, we want to make sure you have a deeper understanding of what double materiality is and why it is needed.

Governments, investors and the public increasingly expect companies to actively address environmental and social issues. Investors, for example, are pursuing more sustainability-focused investment policies. To meet the changing needs of stakeholders and the demand for comprehensive disclosure of environmental impacts, the development of more robust reporting guidelines, such as the ESRS, is being driven. As a result, double materiality has emerged as a key concept, encouraging companies to broaden their focus beyond financial performance.

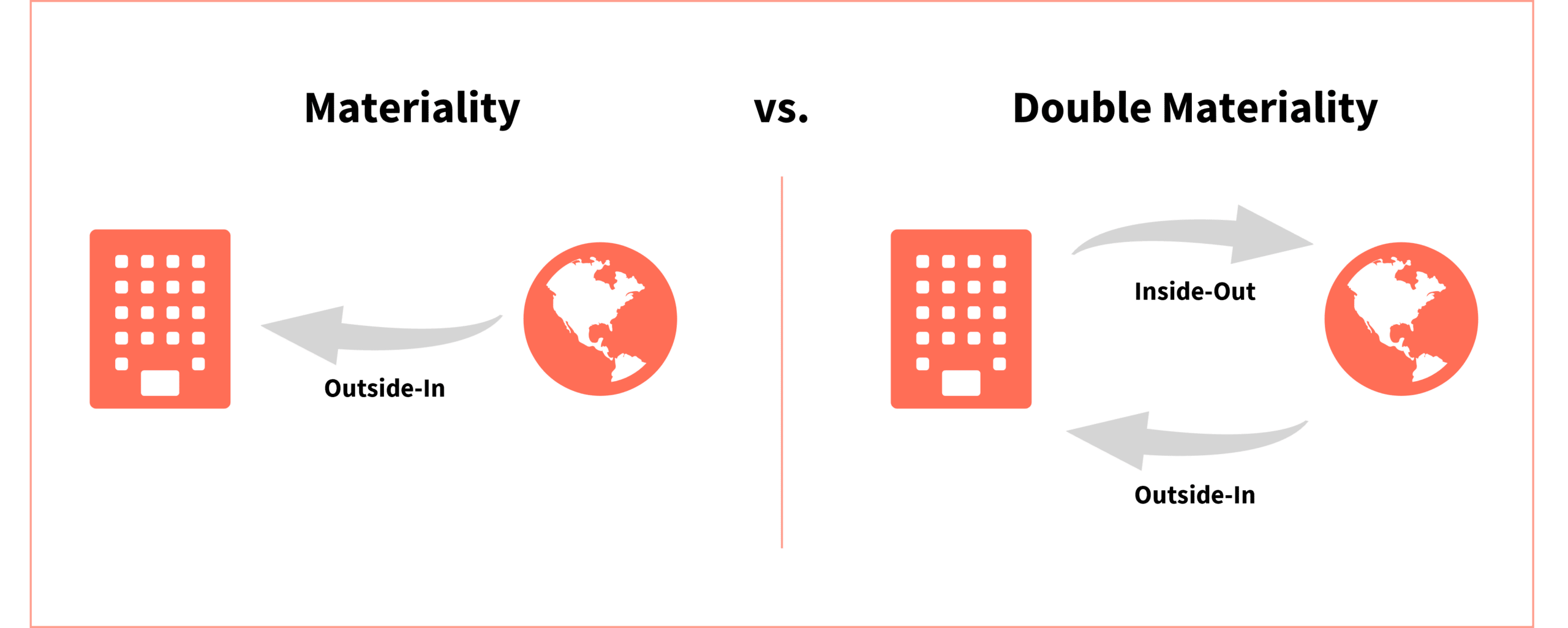

The double materiality advocates analysing the impact of a company’s activities. These relate to environmental sustainability, social responsibility and ethical considerations. In other words, the principle of double materiality takes the concept of materiality in sustainability reporting to a more comprehensive level. It requires companies to disclose information not only about how sustainability issues affect their business (outside-in perspective) but also about how their operations influence society and the environment (inside-out perspective).

In practical terms, businesses are now required to consider two key perspectives:

- What matters materially to their own operations

- What matters materially to society or the planet

To make it even more clear, we will briefly explain the difference between double materiality and single materiality.

Difference between single materiality and double materiality?

The concept of single materiality (used, for example, by the International Sustainability Standards Board (ISSB)) centers around assessing how climate and other ESG factors impact an organization’s financial performance and market standing. Organizations conduct single materiality assessments to identify risks and opportunities that could significantly influence their operations, earnings, physical assets, and overall enterprise value. This approach focuses exclusively on understanding how external factors affect the organization, without explicitly considering the organization’s reciprocal impacts on the environment.

On the other hand, double materiality represents a more comprehensive framework that recognizes the reciprocal relationship between an organization and its external context. While single materiality concentrates on how the organization is affected by external factors, double materiality broadens this perspective to include an examination of how the organization, in turn, influences the external environment. This holistic approach aims to capture the dual significance of sustainability impacts – considering both the external influences on the organization and the organization’s impacts on the broader climate and environment.

Outside-In vs. Inside-Out perspective

Double materiality example

Let’s dive briefly into a vivid example of double materiality in the financial services industry. Imagine a bank carefully assessing its lending practices and loan portfolios. The goal is not only to nurture financial growth but also to ensure that the bank isn’t indirectly funding activities harmful to the environment.

Picture this: The bank, like an eco-conscious investor, decides to divest from fossil fuel investments. This move not only aligns with a positive environmental impact by reducing carbon footprints but also has ripple effects on the bank’s financial landscape. As the bank divests from fossil fuels, it not only contributes to a healthier planet but also alters its financial performance and lending risk.

If you think about this through a few examples, you will quickly realize that double materiality also has some advantages. We highlight three of them below.

What are the benefits of double materiality?

Adopting a double materiality approach in sustainability reporting offers a wide range of advantages, including:

1- Comprehensive insight

Double materiality provides a deeper and more holistic understanding of a company’s sustainability performance by evaluating both financial and non-financial impacts. This allows companies to consider how sustainability issues affect the business and how the business impacts society and the environment.

2- Stakeholder alignment

By focusing on the interests of multiple stakeholders, double materiality helps organizations align their sustainability efforts with the expectations of investors, customers, employees, regulators, and communities, thereby fostering trust and long-term value creation.

3- Enhanced risk management

It enables companies to better identify, assess, and mitigate environmental, social, and governance (ESG) risks. By understanding the full scope of their impact, businesses can proactively manage emerging risks and seize new opportunities in areas like regulatory compliance and innovation.

4- Future-proofing the business

This approach ensures companies stay ahead of evolving regulations and societal expectations, protecting against reputational damage and ensuring they remain competitive in an increasingly sustainability-focused market.

5- Value creation and differentiation

Companies adopting double materiality can use their sustainability initiatives as a competitive advantage, differentiating themselves by demonstrating a strong commitment to ethical and sustainable practices, which attracts investors and customers alike.

6- Long-term strategic planning

By integrating double materiality into business strategy, companies are better equipped to plan for long-term success, ensuring that both financial and non-financial aspects are embedded in decision-making processes.

What does the ESRS say about double materiality?

Double materiality plays a pivotal role within the framework of the European Sustainability Reporting Standards. The ESRS categorizes double materiality into two distinct perspectives:

- Impact materiality, representing the “inside-out” perspective

- Financial materiality, reflecting the “outside-in” perspective

In the ESRS they are defined as follows:

European Sustainability Reporting Standards (ESRS), p. 7

European Sustainability Reporting Standards (ESRS), p. 8

If you’ve made it this far, you should now have a good understanding of double materiality. Therefore, let’s now take a deeper look into the assessment of double materiality.

What is a double materiality assessment?

Conducting a double materiality assessment is the critical first step in achieving CSRD compliance. This process enables companies within scope to identify the specific disclosure requirements of the ESRS that apply to them and which ESG topics they have to include in their sustainability reporting.

Think of it this way: the double materiality assessment acts as a compass, ensuring that your company’s sustainability reports focus on the topics that really matter in your unique context. It’s not about cherry-picking what’s right for the company; it’s about creating reports that authentically reflect the issues that are relevant and impactful. In this way, compliance becomes a meaningful journey of transparency and relevance.

For this purpose, the ESRS offers a range of ESG topics, including climate change, pollution, water and marine resources, biodiversity, circular economy, and more. Companies, irrespective of their industries, are encouraged to incorporate these topics into their materiality assessment. These should serve as a foundational reference for companies to identify additional information to disclose and to determine the relevance of specific ESG topics for their organization. This assessment should consider the business context and unique circumstances of each company.

How should companies following the ESRS conduct a double materiality assessment?

The ESG also provide comprehensive guidelines on the process of conducting a double materiality assessment. To offer a brief summary, these guidelines can be categorized as follows:

Step 1: Make a list of sustainability topics that might be relevant

Identify all the sustainability topics from the ESRS list that are relevant and therefore also might be material to your organization. Take into account factors such as the nature of your sector’s activities, geographical locations of operation, and the entirety of your value chain.

Step 2: Define impacts, risks and opportunities

Now, let’s take a look at the next step, which is identifying the impacts, risks, and opportunities linked to environmental, social, and governance aspects across a company’s operations as well as its value chain. The result? A comprehensive “long list” that lays out these impacts, risks, and opportunities, forming the foundation for deeper assessment and analysis in the following stages.

Step 3: Assess impacts, risks and opportunities

Once sustainability considerations are outlined in terms of their impacts, risks, and opportunities, the next step is to quantify these factors. This involves assessing their significance in terms of both environmental and social impact (impact materiality) and their financial implications (financial materiality). Following the evaluation of all impacts, risks, and opportunities, organizations can create holistic lists for negative impacts, positive impacts, risks and opportunities and their materiality. These lists can then be divided into material and immaterial impacts, risks and opportunities by choosing a specific threshold. Determining an appropriate threshold might be seen as the challenge here, as the ESRS provides limited guidance on this matter.

Step 4: Strategic implications

Companies need to share details about how they plan to address material sustainability topics. This involves revealing specific objectives and metrics for each topic, along with the strategies they’ll use to achieve those goals. It’s a way for companies to be transparent about their efforts and progress in making positive environmental and social impacts.

Summary

In a nutshell, double materiality is a game-changer in sustainability reporting, pushing companies to look beyond just finances. It’s about understanding how a company impacts the world and vice versa. Different from single materiality, it considers both external factors affecting a company and the company’s influence on the world. The perks? A complete picture of sustainability, alignment with stakeholders, and improved risk management. For CSRD compliance, companies need a double materiality assessment – a compass for authentic disclosure of relevant ESG topics. It’s not just about ticking boxes; it’s a journey toward transparency and impact. Double materiality encourages companies to go beyond compliance and actively contribute to a sustainable world.

Your Next Steps

Make sure to use our free double materiality assessment template as a starting point for the first three steps of the assessment. We are sure you will find it helpful!